Types of Business Structures

- Sole Proprietor

- Partnership

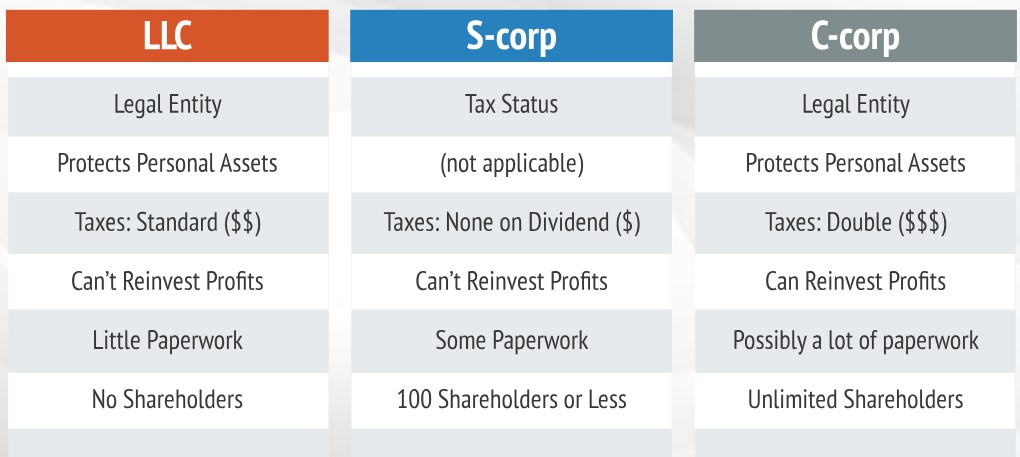

- Limited Liability Company (LLC)

- S-Corp

- C-Corp

What is a Sole Proprietor and what are the pros and cons?

A sole proprietorship, often abbreviated as “sole prop,” is the simplest form of business structure where a single individual owns and operates the business. Here are the key characteristics, pros, and cons:

Characteristics:

- Ownership: Owned and managed by one person.

- Liability: The owner has unlimited personal liability for debts and obligations of the business.

- Taxation: Profits and losses are reported on the owner’s personal income tax return.

- Control: The owner has complete control over decision-making.

Pros:

- Easy to Start: Minimal legal formalities and low startup costs compared to other business structures.

- Direct Control: The owner has full control over business operations and decision-making.

- Tax Simplicity: Easier tax reporting since profits and losses are reported on the owner’s personal tax return.

- Flexibility: Flexibility in management and operations allows quick adaptation to changing market conditions.

Cons:

- Unlimited Liability: The owner is personally liable for all debts and obligations of the business. This means personal assets could be at risk.

- Limited Growth Potential: Sole proprietors may find it challenging to raise capital compared to larger business structures.

- Limited Expertise: The owner may have limited expertise in all areas of business management (e.g., accounting, marketing), which can affect decision-making.

- Business Continuity: The business is closely tied to the owner, so continuity can be a concern if the owner becomes incapacitated or wishes to sell the business.

Conclusion:

A sole proprietorship is ideal for small businesses or solo entrepreneurs who want simplicity and full control over their business operations. However, potential unlimited liability and limited growth potential should be carefully considered. As the business grows, many sole proprietors may eventually consider transitioning to a more complex business structure like a partnership or corporation to mitigate risks and facilitate expansion.

What is a Partnership and what are the pros and cons?

A partnership is a type of business structure where two or more individuals (partners) agree to share the profits, losses, and responsibilities of running a business together. Here’s an overview of partnerships along with their pros and cons:

Characteristics:

- Ownership: Shared ownership among partners who contribute capital, skills, or both.

- Liability: Partners typically have unlimited liability, meaning they are personally liable for the debts and obligations of the partnership.

- Management: Partners jointly manage the business, unless otherwise specified in a partnership agreement.

- Taxation: Profits and losses “pass through” to the partners, who report them on their individual tax returns.

Types of Partnerships:

- General Partnership: Partners share equally in the profits, losses, and management of the business.

- Limited Partnership: Includes general partners who manage the business and have unlimited liability, and limited partners who invest capital but have limited liability and no management authority.

Pros:

- Shared Responsibility and Skills: Partners can pool resources, expertise, and skills, which can lead to more effective decision-making and operational efficiency.

- Shared Risk: Partners share the financial risks and liabilities of the business, potentially reducing the burden on each individual.

- Tax Advantages: Partnerships offer pass-through taxation, meaning the business itself is not taxed; instead, profits and losses flow through to the partners’ personal tax returns.

- Ease of Formation: Relatively easy and inexpensive to establish compared to corporations, with fewer regulatory requirements.

Cons:

- Unlimited Liability: In a general partnership, each partner is personally liable for the debts and obligations of the business, including actions of other partners.

- Disagreements: Differences in management styles, decision-making, or financial goals can lead to conflicts among partners.

- Shared Profits: Profits must be shared among partners according to the partnership agreement, which may not always align with individual efforts or contributions.

- Limited Life: Partnerships can be dissolved if a partner wishes to leave, dies, or becomes incapacitated, which can disrupt continuity and stability.

Conclusion:

Partnerships are a flexible and collaborative way for two or more individuals to operate a business together, leveraging shared resources and expertise. However, potential unlimited liability and the need for clear communication and a solid partnership agreement are important considerations. Partnerships are particularly suitable for small to medium-sized businesses where partners have complementary skills and a shared vision for growth and success.

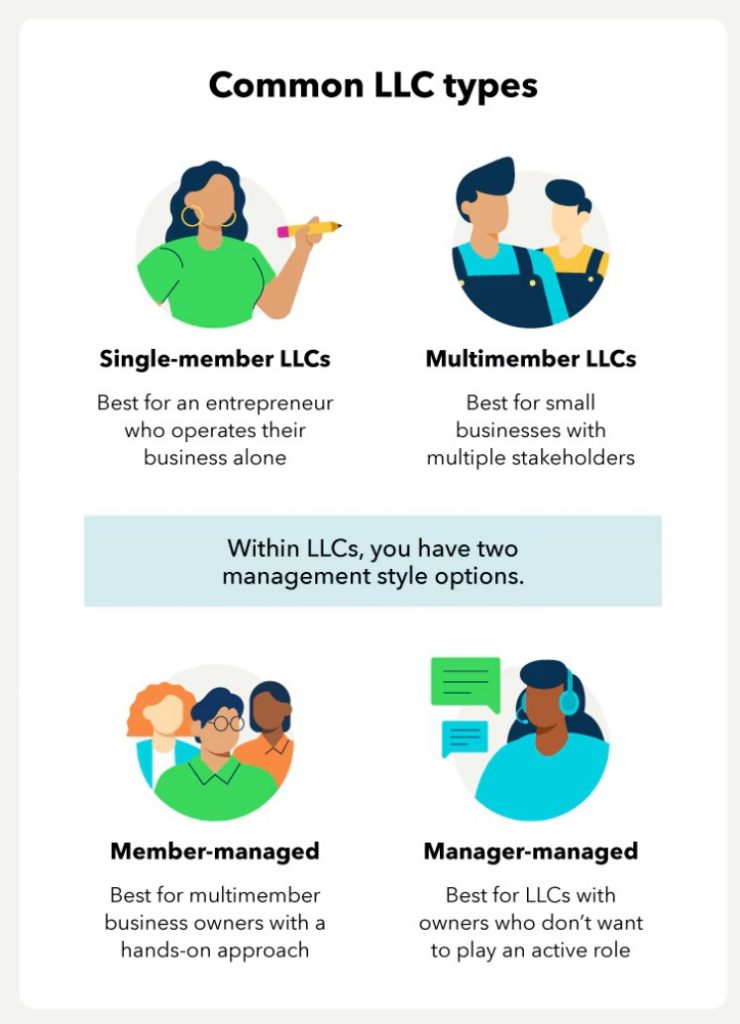

What is an LLC and what are the pros and cons?

A Limited Liability Company (LLC) is a hybrid business entity that combines elements of a corporation and a partnership. It provides limited liability protection to its owners (called members) while offering flexibility in management and taxation. Here’s an overview of LLCs along with their pros and cons:

Characteristics:

-

Limited Liability: Members are typically not personally liable for the debts and obligations of the LLC. Their personal assets are protected, similar to shareholders of a corporation.

-

Flexibility in Management: LLCs can be managed either by all members (member-managed) or by appointed managers (manager-managed), providing flexibility in decision-making structures.

-

Pass-Through Taxation: By default, LLCs are taxed as pass-through entities. This means profits and losses are reported on the members’ personal tax returns, avoiding double taxation like in a corporation.

-

Ease of Formation and Maintenance: LLCs are relatively simple to form and maintain compared to corporations. Requirements vary by state but generally involve filing articles of organization and drafting an operating agreement.

Pros:

-

Limited Liability: Members are shielded from personal liability for business debts and lawsuits, protecting their personal assets.

-

Pass-Through Taxation: LLCs avoid double taxation since profits and losses pass through to members’ personal tax returns, potentially resulting in lower overall taxes.

-

Flexible Management: Members can choose how they want the LLC to be managed—either by themselves (member-managed) or by appointed managers (manager-managed).

-

Credibility: Operating as an LLC can enhance credibility with customers, suppliers, and partners, as it signals a formalized business structure.

-

Fewer Formalities: Compared to corporations, LLCs generally have fewer ongoing formalities and less paperwork.

Cons:

-

State-Specific Rules: LLCs are governed by state law, and regulations can vary significantly from state to state, which may affect formation and ongoing requirements.

-

Self-Employment Taxes: Members of an LLC may be subject to self-employment taxes on their share of the profits, which can be higher than the taxes paid by employees of corporations.

-

Limited Life: In many states, the death or withdrawal of a member can lead to dissolution unless the operating agreement provides for continuation.

-

Perception: In some industries, corporations may be perceived as more established or prestigious than LLCs.

Conclusion:

LLCs offer a compelling blend of liability protection, tax flexibility, and operational ease, making them a popular choice for many small to medium-sized businesses and startups. The decision to form an LLC should consider specific business goals, the nature of the business, and potential tax implications, among other factors. Consulting with legal and tax professionals can help ensure that an LLC structure aligns with your business needs and objectives.

What is an S-Corp and what are the pros and cons?

An S-Corporation (S-Corp) is a specific tax designation granted by the IRS to eligible corporations, allowing them to avoid the double taxation typically associated with regular corporations (C-Corps). Here’s an overview of what an S-Corp is, along with its pros and cons:

Characteristics:

-

Taxation: S-Corps are pass-through entities for tax purposes. This means that the corporation itself does not pay federal income taxes. Instead, profits and losses are “passed through” to the shareholders’ personal tax returns, where they are taxed at individual income tax rates.

-

Ownership: S-Corps can have up to 100 shareholders, all of whom must be U.S. citizens or residents. Shareholders must also be individuals, certain trusts, or estates—corporations and partnerships cannot be shareholders.

-

Limited Liability: Like C-Corps and LLCs, S-Corps provide limited liability protection to their shareholders, meaning shareholders generally are not personally liable for the debts and liabilities of the corporation.

-

Operational Formalities: S-Corps are required to follow certain formalities such as adopting bylaws, holding regular director and shareholder meetings, maintaining corporate minutes, and issuing stock.

Pros:

-

Pass-Through Taxation: Avoidance of double taxation is a significant advantage. Profits are taxed only once at the individual shareholder level, potentially resulting in lower overall taxes compared to C-Corps.

-

Limited Liability: Shareholders enjoy limited liability protection, shielding personal assets from the debts and liabilities of the corporation.

-

Investment and Growth: S-Corps can attract investors more easily than LLCs due to the corporate structure, which allows for the issuance of stock.

-

Tax Flexibility: S-Corps can provide flexibility in distributing income to shareholders, potentially allowing for tax planning strategies.

Cons:

-

Eligibility Restrictions: S-Corps have strict eligibility requirements, including limitations on the number and type of shareholders, which can restrict growth and investor options.

-

Operational Requirements: S-Corps are required to follow more formalities than partnerships and LLCs, including holding regular meetings and maintaining corporate records.

-

Payroll Taxes: Shareholders who work for the corporation must receive reasonable compensation, subject to payroll taxes, which can be higher than the self-employment taxes of LLC members.

-

Limited Life: Like other corporate structures, the death or withdrawal of a shareholder can affect the continuity and stability of the S-Corp.

Conclusion:

S-Corps can offer substantial tax benefits and limited liability protection for eligible businesses, making them an attractive option for many small to medium-sized enterprises. However, the eligibility criteria, operational formalities, and potential tax implications should be carefully considered when deciding whether to elect S-Corp status. Consulting with legal and tax professionals can help determine if an S-Corp is the right choice for your business goals and circumstances.

What is a C-Corp and what are the pros and cons?

A C-Corporation (C-Corp) is a legal structure that establishes a separate legal entity owned by shareholders. Here’s an overview of what a C-Corp is, along with its pros and cons:

Characteristics:

-

Separate Legal Entity: A C-Corp is a distinct legal entity separate from its owners (shareholders). It can own assets, enter into contracts, sue, and be sued in its own name.

-

Limited Liability: Shareholders typically have limited liability, meaning their personal assets are protected from the debts and liabilities of the corporation.

-

Taxation: C-Corps are subject to “double taxation.” The corporation itself pays corporate income tax on its profits. When dividends are distributed to shareholders, those dividends are taxed again at the individual shareholder level.

-

Ownership: C-Corps can have an unlimited number of shareholders, including individuals, other corporations, and foreign entities.

Pros:

-

Limited Liability: Shareholders enjoy limited liability, protecting their personal assets from the debts and liabilities of the corporation.

-

Growth and Investment: C-Corps can attract investors more easily than other business structures due to the ability to issue multiple classes of stock and offer stock options.

-

Perpetual Existence: The life of a C-Corp is not tied to the life of its owners or shareholders, allowing for continuity and stability.

-

Tax Deductions: C-Corps can deduct many business expenses, such as salaries, benefits, and operational costs, which can reduce taxable income.

Cons:

-

Double Taxation: One of the main drawbacks of a C-Corp is double taxation—profits are taxed at the corporate level, and then dividends distributed to shareholders are taxed again at the individual level.

-

Complexity and Formalities: C-Corps are subject to more regulatory and compliance requirements compared to other business structures, including holding regular meetings, maintaining corporate records, and filing separate tax returns.

-

Costs: Setting up and maintaining a C-Corp can be more expensive and time-consuming compared to other business structures, such as partnerships or LLCs.

-

Less Flexibility: C-Corps have less flexibility in how profits are distributed compared to pass-through entities like partnerships or LLCs, where profits and losses flow directly to the owners’ personal tax returns.

Conclusion:

C-Corps are suitable for businesses aiming for substantial growth, attracting investors, and maintaining limited liability protection for shareholders. However, the potential for double taxation and the higher regulatory burden should be carefully considered when deciding whether to form a C-Corp. Many small businesses and startups may opt for alternative structures like LLCs or S-Corps due to their flexibility and tax advantages, while larger enterprises often choose C-Corps to leverage the benefits of stock issuance and investor appeal.

Insurance Planning

Insurance planning refers to the process of evaluating and managing risks through the use of insurance products. It involves assessing potential risks that individuals or businesses may face and determining appropriate insurance coverage to mitigate those risks. Here’s an overview of what insurance planning entails:

Key Components of Insurance Planning:

-

Risk Assessment: This involves identifying and evaluating potential risks that could lead to financial losses or liabilities. Risks can include health issues, accidents, property damage, liability claims, and more.

-

Insurance Needs Analysis: Once risks are identified, the next step is to determine the types and amounts of insurance coverage needed to protect against those risks. Factors considered include personal or business assets, liabilities, income levels, and specific risks relevant to the individual or business.

-

Choosing Insurance Products: Based on the needs analysis, insurance planners recommend specific insurance products that align with the identified risks and coverage requirements. Common types of insurance include life insurance, health insurance, property insurance (e.g., home insurance, car insurance), liability insurance, and business insurance (e.g., professional liability, commercial property).

-

Cost-Benefit Analysis: Evaluating the costs versus the benefits of insurance coverage is crucial. This includes considering premiums, deductibles, coverage limits, exclusions, and the financial impact of potential losses.

-

Reviewing and Updating Coverage: Insurance planning is an ongoing process. It involves periodically reviewing insurance policies to ensure they still meet the individual or business’s needs. Changes in personal circumstances (e.g., marriage, birth of children) or business operations (e.g., expansion, new risks) may necessitate adjustments to insurance coverage.

Importance of Insurance Planning:

-

Risk Management: Insurance planning helps individuals and businesses transfer potential financial risks to an insurance company in exchange for premiums, thus protecting against catastrophic losses.

-

Financial Security: Adequate insurance coverage provides financial security by covering medical expenses, property damage repairs, legal liabilities, and other costs that may arise from unexpected events.

-

Compliance and Protection: Certain types of insurance (e.g., health insurance for individuals, workers’ compensation for businesses) may be required by law or industry regulations to protect against specific risks and liabilities.

-

Peace of Mind: Knowing that adequate insurance coverage is in place can provide peace of mind, reducing stress and uncertainty about potential financial hardships.

Conclusion:

Insurance planning is a fundamental aspect of personal finance and risk management for businesses. By identifying risks, assessing insurance needs, selecting appropriate coverage, and regularly reviewing policies, individuals and businesses can effectively protect themselves from financial losses due to unforeseen events. Seeking advice from insurance professionals or financial advisors can help ensure that insurance planning strategies are comprehensive and tailored to specific needs and circumstances.

Most Common types of Insurance Planning

- Group Health Insurance

- Group Life Insurance

- Group Disability Insurance

- Disability Overhead Expense

- Key Person Insurance/ Buy-Sell Agreement

What is Group Health Insurance?

Key Features of Group Health Insurance:

-

Employer-Sponsored: Group health insurance is sponsored by an employer or organization, which negotiates with insurance companies to provide coverage to eligible employees and their dependents.

-

Coverage for Employees and Dependents: Typically, group health insurance covers not only employees but also their spouses, children, and sometimes other dependents. Coverage can vary based on the specific plan chosen by the employer.

-

Cost Sharing: Employers often pay a portion of the premium costs for employees, making group health insurance more affordable compared to individual health insurance plans. Employees may also contribute to premiums through payroll deductions.

-

Comprehensive Coverage: Group health insurance plans typically offer comprehensive coverage for a range of medical services, including hospitalization, doctor visits, preventive care, prescription drugs, and sometimes dental and vision care.

-

Network Providers: Group health insurance plans often have networks of healthcare providers (doctors, hospitals, clinics) with whom they have negotiated discounted rates. Using in-network providers typically results in lower out-of-pocket costs for employees.

-

Annual Enrollment Period: Employees usually have an annual open enrollment period during which they can choose their health insurance plan options, add dependents, and make changes to coverage levels.

-

COBRA Coverage: Under federal law, employees who leave their job (voluntarily or involuntarily) may have the option to continue their group health insurance coverage for a limited period through the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Pros of Group Health Insurance:

-

Cost-Effective: Group health insurance premiums are often lower than individual health insurance premiums because the risk is spread across a larger group of individuals.

-

Employer Contribution: Many employers subsidize a significant portion of the premium costs for employees, making health insurance more affordable for employees and their families.

-

Comprehensive Coverage: Group health insurance plans typically provide broad coverage for medical services, helping to protect employees from high out-of-pocket expenses for healthcare.

-

No Medical Underwriting: Employees generally do not need to undergo medical underwriting to qualify for coverage under a group health insurance plan, making it easier for individuals with pre-existing conditions to obtain coverage.

Cons of Group Health Insurance:

-

Limited Choice: Employees may have limited choices of health insurance plans and providers compared to individual health insurance, depending on the employer’s offerings and network restrictions.

-

Portability Issues: Coverage typically ends if an employee leaves the company, although COBRA and other options may provide temporary continuation of coverage.

-

Dependence on Employer: Employees rely on their employer to choose and administer the health insurance plan, which may change annually and could affect coverage options.

Conclusion:

Group health insurance is a valuable employee benefit that provides access to affordable healthcare coverage for employees and their families. It offers comprehensive benefits, cost-sharing between employers and employees, and typically requires no medical underwriting for eligibility. Employers should carefully select health insurance plans that meet the needs of their workforce, and employees should review plan options during open enrollment to ensure they choose the best coverage for themselves and their families.

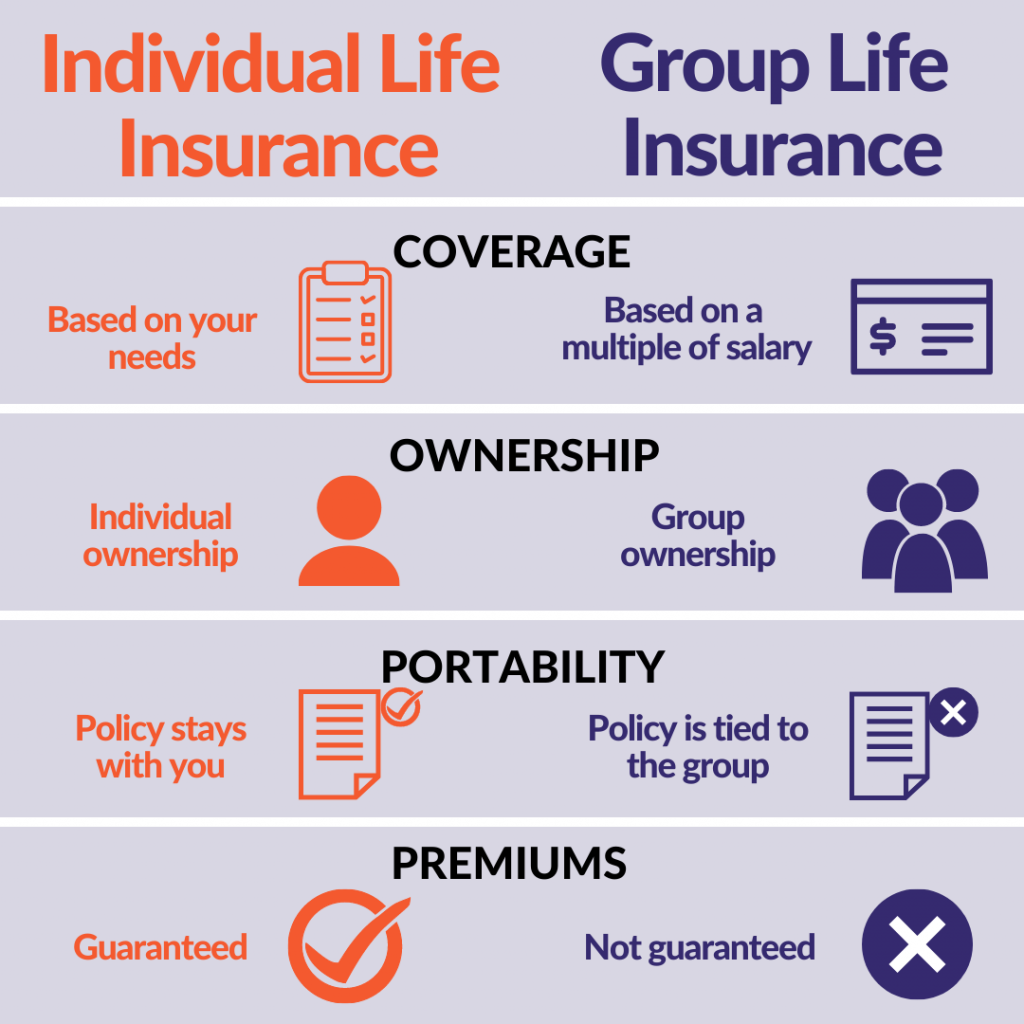

What is Group Life Insurance?

Group life insurance is a type of life insurance coverage that employers typically offer to their employees as part of their benefits package. Here’s an overview of group life insurance and how it works:

Key Features of Group Life Insurance:

-

Coverage for Employees: Group life insurance provides life insurance coverage for a group of people, usually employees of a company or members of an organization. It is typically offered at a lower cost compared to individual life insurance policies because the risk is spread across the group.

-

Employer-Sponsored: Group life insurance is sponsored and often partially or fully paid for by the employer. Employers may offer a basic amount of coverage at no cost to employees, with the option to purchase additional coverage through payroll deductions.

-

Term Life Insurance: Most group life insurance policies are term life insurance policies, meaning they provide coverage for a specific period (e.g., one year, renewable annually). If an employee leaves the company or the group coverage ends, the coverage generally terminates unless conversion options are available.

-

Simplified Underwriting: Group life insurance typically requires minimal or no medical underwriting. This means employees generally do not need to undergo a medical examination or provide detailed health information to qualify for coverage.

-

Beneficiary Designation: Employees can typically designate beneficiaries who will receive the death benefit in the event of their death. Beneficiaries may include family members, dependents, or other individuals chosen by the insured.

Pros of Group Life Insurance:

-

Cost-Effective: Group life insurance is often more affordable than individual life insurance policies because the risk is spread across a larger group of individuals.

-

Employer Contribution: Many employers subsidize the cost of basic coverage, providing valuable benefits to employees at little or no cost to them.

-

Convenience: Enrollment in group life insurance is usually straightforward and may not require extensive paperwork or medical exams.

-

No Medical Underwriting: Employees with pre-existing health conditions may find it easier to obtain coverage under a group plan compared to individual policies.

Cons of Group Life Insurance:

-

Limited Coverage Amounts: Group life insurance policies often have lower coverage limits compared to what individuals might purchase on their own.

-

Portability Issues: Coverage typically ends if an employee leaves the company, although some plans may offer conversion options to individual policies.

-

Tax Considerations: While premiums for basic coverage are usually tax-deductible for employers, the value of coverage above $50,000 is considered taxable income for employees.

Conclusion:

Group life insurance provides valuable life insurance coverage for employees and their families at a relatively low cost. It’s an important benefit that employers offer to attract and retain talent. However, employees should carefully review the coverage amount, terms, and portability options to ensure their insurance needs are adequately met both now and in the future.

What is Group Disability Insurance?

Key Features of Group Disability Insurance:

-

Income Replacement: Group disability insurance provides a percentage of the insured employee’s income as a monthly benefit if they become disabled and are unable to work. This benefit helps replace lost income during the period of disability.

-

Employer-Sponsored: Similar to group life insurance, group disability insurance is typically sponsored and often partially or fully paid for by the employer. It is offered as part of the employee benefits package.

-

Types of Coverage:

- Short-Term Disability (STD): Provides benefits for a limited duration, such as a few weeks to several months, typically covering temporary disabilities.

- Long-Term Disability (LTD): Provides benefits for an extended period, potentially until retirement age, covering more severe and long-lasting disabilities.

-

Definition of Disability: The policy defines what qualifies as a disability, which may vary but generally includes conditions that prevent an employee from performing their job duties. Some policies have stricter definitions of disability than others.

-

Elimination Period: This is the waiting period before disability benefits begin to accrue after the onset of disability. Short-term disability policies often have shorter elimination periods (e.g., 7 days), while long-term disability policies typically have longer elimination periods (e.g., 90 days).

-

Benefit Amount: The amount of disability benefits typically replaces a percentage of the employee’s pre-disability income, often around 60-70%, up to a maximum monthly benefit amount specified in the policy.

-

Benefit Duration: Long-term disability policies may pay benefits until the employee is able to return to work, reaches retirement age, or the policy term ends, depending on the terms of the policy.

Pros of Group Disability Insurance:

-

Income Protection: Provides essential income replacement for employees who are unable to work due to disability, helping them meet financial obligations and maintain their standard of living.

-

Employer Contribution: Many employers subsidize the cost of disability insurance, making it a valuable benefit for employees at little or no cost to them.

-

No Medical Underwriting: Group disability insurance typically does not require extensive medical underwriting, making it easier for employees to qualify for coverage compared to individual disability insurance policies.

-

Convenience: Enrollment in group disability insurance is usually straightforward and part of the overall benefits enrollment process provided by the employer.

Cons of Group Disability Insurance:

-

Coverage Limits: Group disability insurance policies may have benefit caps or limitations on coverage amounts, which may not fully replace high-income earners’ salaries.

-

Definition of Disability: Policies may have strict definitions of disability, potentially limiting coverage for certain conditions or circumstances.

-

Portability Issues: Coverage typically ends if an employee leaves the company, although some plans may offer conversion options or portable coverage.

Conclusion:

Group disability insurance is a valuable employee benefit that provides financial protection to employees in the event they become disabled and are unable to work. It helps replace lost income and provides peace of mind during challenging times. Employers and employees should carefully review the terms, coverage amounts, and portability options of group disability insurance to ensure it meets their needs and provides adequate protection against income loss due to disability.

What is Disability Overhead Expense?

Disability Overhead Expense (DOE) insurance, also known simply as Overhead Expense Insurance, is a type of insurance that helps cover the ongoing fixed expenses of a business when the owner or a key employee becomes disabled and is unable to work due to illness or injury. Here’s a detailed explanation of Disability Overhead Expense insurance and its key features:

Key Features of Disability Overhead Expense Insurance:

-

Purpose: Disability Overhead Expense insurance is specifically designed to cover essential business overhead expenses that continue to accrue even if the business owner or a key employee is disabled and unable to work. These expenses typically include rent or mortgage payments, utilities, employee salaries, taxes, insurance premiums, and other fixed costs necessary to keep the business operational.

-

Coverage Scope: Unlike Disability Income Insurance, which replaces the disabled individual’s lost income, Disability Overhead Expense insurance focuses on reimbursing the actual expenses incurred by the business during the disability period. It helps ensure that the business can continue to function and meet its financial obligations.

-

Eligibility: To qualify for benefits, the insured individual (usually the business owner or a key employee) must become disabled according to the policy’s definition of disability. Disability is generally defined as the inability to perform the substantial and material duties of their occupation due to injury or illness.

-

Benefit Amount: Disability Overhead Expense insurance policies specify a monthly benefit amount, which represents the maximum reimbursement the policy will provide for eligible overhead expenses during the disability period. This benefit amount is selected based on the estimated monthly overhead expenses of the business.

-

Waiting Period: Similar to other types of disability insurance, Disability Overhead Expense policies often include a waiting period (elimination period) before benefits become payable. The waiting period typically ranges from 30 to 90 days and represents the initial period of disability during which no benefits are paid.

-

Duration of Benefits: Benefits under Disability Overhead Expense insurance are usually payable for a limited period, commonly ranging from 12 to 24 months. The exact duration of benefits depends on the terms specified in the policy.

-

Premiums: Premiums for Disability Overhead Expense insurance are typically tax-deductible as a business expense, similar to other forms of business insurance. The cost of premiums may vary based on factors such as the insured individual’s age, health condition, occupation, and the chosen benefit amount.

Pros of Disability Overhead Expense Insurance:

-

Business Continuity: Helps ensure continuity of business operations by covering essential overhead expenses during the disability of the business owner or key employee.

-

Financial Stability: Protects the business from financial hardship and potential bankruptcy that could result from the loss of the owner’s or key employee’s active involvement.

-

Tax Deductibility: Premiums paid for Disability Overhead Expense insurance are generally tax-deductible as a business expense, providing additional financial benefits to the business.

Cons of Disability Overhead Expense Insurance:

-

Limited Coverage Period: Benefits are typically provided for a specified period (e.g., 12 to 24 months), which may not be sufficient for disabilities that extend longer than expected.

-

Cost: Premiums for Disability Overhead Expense insurance can be relatively high compared to other types of insurance, reflecting the specific coverage and risks associated with business overhead expenses.

-

Qualification Requirements: Business owners and key employees must meet the policy’s definition of disability to qualify for benefits, and policies may have specific exclusions or limitations.

Conclusion:

Disability Overhead Expense insurance is a valuable risk management tool for businesses, particularly small businesses, to protect against the financial impact of a disability that prevents the owner or key employees from actively running the business. It helps maintain business continuity by covering essential overhead expenses and provides peace of mind knowing that the business can continue operating during a period of disability. Business owners should carefully evaluate their specific business needs and financial circumstances when considering Disability Overhead Expense insurance, and they may benefit from consulting with an insurance professional or financial advisor to select the appropriate coverage.

What is Key Person Insurance/ Buy-Sell Agreement?

Key Person Insurance and Buy-Sell Agreements are two distinct but related concepts often used in business planning, particularly in small to medium-sized businesses. Here’s an overview of each:

Key Person Insurance:

Key Person Insurance (also known as Key Man Insurance or Key Employee Insurance) is a type of life and/or disability insurance purchased by a business to protect itself from financial losses that may arise from the death or disability of a key employee. A key employee is typically someone whose skills, knowledge, experience, or leadership are crucial to the business’s success and whose loss would have a significant impact on the business’s operations and profitability.

Key Features of Key Person Insurance:

-

Purpose: The primary purpose of Key Person Insurance is to compensate the business for financial losses that may occur due to the death or disability of a key employee. It helps the business continue operations, hire a replacement, or compensate for lost revenue during a transitional period.

-

Ownership and Beneficiary: The business owns the insurance policy, pays the premiums, and is the beneficiary of the policy. If the insured key person dies or becomes disabled, the business receives the insurance proceeds to mitigate financial losses.

-

Coverage Amount: The coverage amount is based on the estimated financial impact of losing the key person. It may include costs associated with finding and training a replacement, loss of revenue, or fulfilling obligations to creditors or investors.

-

Tax Considerations: Premiums for Key Person Insurance are generally not tax-deductible, but the insurance proceeds are typically received tax-free if structured correctly.

Buy-Sell Agreement:

A Buy-Sell Agreement (or Buyout Agreement) is a legally binding agreement between business owners (partners or shareholders) that governs what happens to a business if a co-owner dies, becomes disabled, retires, or otherwise leaves the business. It establishes the terms and conditions under which the ownership interest of a departing owner will be sold or transferred.

Key Features of a Buy-Sell Agreement:

-

Purpose: The primary purpose of a Buy-Sell Agreement is to provide a mechanism for the orderly transfer of ownership in the event of a triggering event (e.g., death, disability) of a business owner. It helps prevent disputes, ensures continuity of business operations, and provides a fair valuation and exit strategy.

-

Triggering Events: The agreement specifies various triggering events that would activate the buyout process, such as death, disability, retirement, resignation, or divorce of a business owner.

-

Valuation Method: The agreement outlines how the business will be valued for the purpose of determining the buyout price. Common valuation methods include appraisals, formulas based on financial metrics, or fixed price agreements.

-

Funding Mechanism: To facilitate the buyout, the agreement may include provisions for funding the purchase of the departing owner’s interest. Funding mechanisms typically include life insurance policies (through Key Person Insurance on the lives of the owners) or installment payments over time.

-

Legal Enforceability: Buy-Sell Agreements are legally enforceable contracts that protect the interests of all parties involved in the business, including owners, heirs, and creditors.

Relationship between Key Person Insurance and Buy-Sell Agreement:

-

Integration: Key Person Insurance is often used as a funding mechanism for Buy-Sell Agreements. If a key owner or partner dies or becomes disabled, the insurance proceeds can provide the necessary funds to buy out their ownership interest as stipulated in the Buy-Sell Agreement.

-

Risk Management: Both Key Person Insurance and Buy-Sell Agreements are essential components of risk management and succession planning for businesses. They help ensure business continuity, financial stability, and the smooth transfer of ownership in the face of unexpected events.

Conclusion:

Key Person Insurance and Buy-Sell Agreements are critical tools for business owners to protect their businesses from financial risks associated with the loss of key personnel and the transfer of ownership. They should be carefully crafted and periodically reviewed to align with the evolving needs and circumstances of the business and its owners. Consulting with legal, financial, and insurance professionals is advisable to create comprehensive and effective plans tailored to specific business situations.

Investment Planning

Key Components of Investment Planning:

-

Goal Setting: The first step in investment planning is defining clear and measurable financial goals. These goals could include saving for retirement, purchasing a home, funding education, or building wealth for financial independence.

-

Risk Tolerance Assessment: Understanding one’s risk tolerance is crucial. Risk tolerance refers to an individual’s ability and willingness to endure fluctuations in the value of their investments. It helps determine the appropriate mix of investments that align with an individual’s comfort level and financial goals.

-

Asset Allocation: Asset allocation involves distributing investments across different asset classes (such as stocks, bonds, real estate, and cash equivalents) based on an individual’s goals, time horizon, and risk tolerance. This diversification helps manage risk and optimize returns.

-

Investment Selection: Once asset allocation is determined, specific investments within each asset class are selected. This could involve choosing individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other investment vehicles.

-

Regular Monitoring and Rebalancing: Investment portfolios should be monitored regularly to ensure they remain aligned with the investor’s goals and risk tolerance. Rebalancing involves adjusting the portfolio periodically to maintain the desired asset allocation, especially after market movements or changes in personal circumstances.

-

Tax Considerations: Investment planning also includes strategies to minimize tax liabilities associated with investments. This may involve utilizing tax-advantaged accounts such as IRAs, 401(k)s, or taking advantage of capital gains tax strategies.

-

Financial Advisor Guidance: Many individuals seek the expertise of financial advisors or investment professionals to help create and implement investment plans tailored to their specific needs and circumstances. Financial advisors can provide insights, recommendations, and ongoing management of investment portfolios.

Objectives of Investment Planning:

-

Wealth Accumulation: Building wealth over time through capital appreciation, dividends, and interest income.

-

Income Generation: Generating regular income streams, particularly during retirement, through dividend-paying stocks, bonds, or other investments.

-

Capital Preservation: Protecting capital from erosion due to inflation or market downturns by investing in stable and secure assets.

-

Tax Efficiency: Minimizing taxes on investment gains and income through strategic investment planning and utilizing tax-efficient investment vehicles.

Strategies in Investment Planning:

-

Long-Term Perspective: Emphasizing the importance of long-term investing and the benefits of compounding returns over time.

-

Diversification: Spreading investments across different asset classes and sectors to reduce risk and optimize returns.

-

Risk Management: Implementing risk management techniques such as asset allocation, diversification, and periodic portfolio rebalancing.

-

Cost Management: Minimizing investment costs such as fees, expenses, and taxes to enhance overall investment returns.

Conclusion:

Investment planning is a structured approach to achieving financial goals through disciplined management of investments. It involves setting clear objectives, assessing risk tolerance, selecting appropriate investments, and monitoring progress over time. By creating a well-defined investment plan aligned with individual circumstances and goals, investors can enhance their financial security, build wealth, and achieve long-term financial success.

Types of Investment Planning

- IRA’s, 401(k)’s, Profit-sharing Plans, Defined Benefit Plans, Restricted Endorsement Bonus Arrangement (REBA)

- Vesting Schedules on 401(k)’s

- Stock Options

What are IRA’s, 401(k)’s, Profit-sharing Plans, Defined Benefit Plans, Restricted Endorsement Bonus Arrangement (REBA)?

1. Individual Retirement Accounts (IRAs):

IRAs are personal retirement savings accounts that offer tax advantages for individuals. There are several types of IRAs:

-

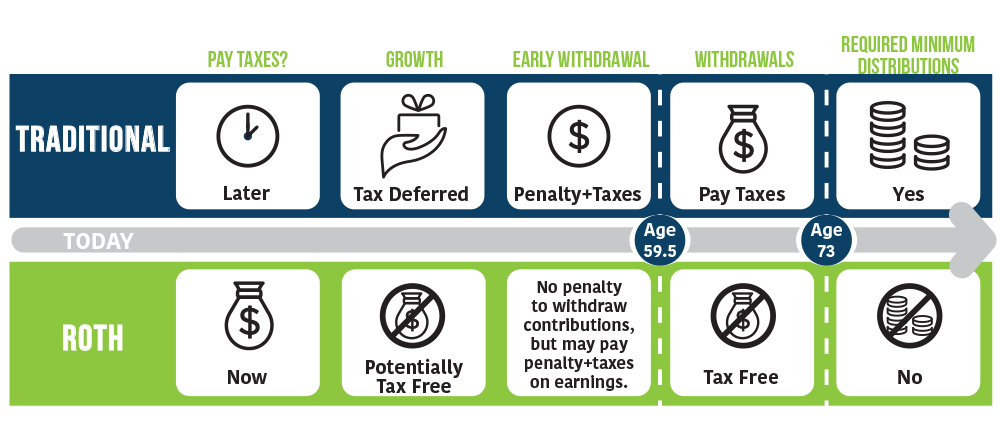

Traditional IRA: Contributions may be tax-deductible (subject to income limits), and earnings grow tax-deferred until withdrawn. Withdrawals in retirement are taxed as ordinary income.

-

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals (including earnings) are tax-free. Roth IRAs also offer more flexibility with withdrawals of contributions before retirement age without penalties.

-

SEP IRA (Simplified Employee Pension IRA): Geared towards self-employed individuals or small business owners, allowing higher contribution limits than traditional IRAs.

-

SIMPLE IRA (Savings Incentive Match Plan for Employees IRA): Designed for small businesses with 100 or fewer employees, offering both employer and employee contributions.

2. 401(k) Plans:

401(k) plans are employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax salary to the plan. Employers may also match a portion of employee contributions. Contributions and earnings grow tax-deferred until withdrawn, typically after retirement age. Withdrawals are taxed as ordinary income.

-

Traditional 401(k): Contributions are made with pre-tax dollars, reducing current taxable income.

-

Roth 401(k): Contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement (if held for a certain period).

3. Profit-Sharing Plans:

Profit-sharing plans are retirement plans where employers contribute a portion of the company’s profits to employees’ retirement accounts. Contributions are discretionary and based on the company’s profitability each year. It’s a way for employers to share company success with employees and provide additional retirement benefits.

4. Defined Benefit Plans:

Defined Benefit Plans, also known as pension plans, promise a specified monthly benefit at retirement. Benefits are usually based on factors such as salary history and years of service. Employers bear the investment risk and are responsible for funding the plan to ensure it can meet its obligations to retirees.

5. Restricted Endorsement Bonus Arrangement (REBA):

Restricted Endorsement Bonus Arrangement (REBA) is a specialized executive compensation arrangement where an executive receives a bonus that is restricted to use for a specific purpose, such as retirement savings or funding a non-qualified deferred compensation plan. REBAs are often structured to provide tax benefits and incentives to retain key executives.

Summary:

Each of these retirement savings vehicles offers unique tax advantages, contribution limits, and eligibility requirements. They play crucial roles in individuals’ and employees’ retirement planning, providing opportunities to save and invest for retirement while minimizing tax liabilities. Choosing the right retirement plan often depends on factors such as employment status, income level, and employer offerings. Consulting with a financial advisor or retirement planning specialist can help determine the most suitable retirement savings strategies based on individual circumstances and goals.

What are Vesting Schedules on 401(k)’s?

Understanding Vesting Schedules:

-

Employer Contributions: Many 401(k) plans include employer contributions, such as matching contributions or profit-sharing contributions. These contributions are made by the employer on behalf of the employee.

-

Vesting: Vesting refers to the process by which employees earn full rights to employer-contributed funds over time. Until employees are fully vested, they may forfeit some or all of the employer-contributed funds if they leave the company prematurely.

Types of Vesting Schedules:

-

Cliff Vesting: With cliff vesting, employees become fully vested in employer contributions after a specified period, often three years. Until that time, they have no vesting rights. For example, if a plan has a cliff vesting schedule of three years, employees would become 100% vested after completing three years of service with the company.

-

Graded Vesting: Graded vesting provides a gradual vesting schedule where employees earn a certain percentage of vesting rights over time. For example, a graded vesting schedule might provide 20% vesting rights after two years, 40% after three years, and so forth, until employees reach 100% vesting after a specified number of years, typically six.

Importance of Vesting Schedules:

-

Retention Incentive: Vesting schedules are used by employers to incentivize employee retention. By requiring employees to stay with the company for a certain period to become fully vested, employers encourage long-term commitment and reduce turnover.

-

Employee Benefits: Fully vested employees retain rights to all employer-contributed funds and related earnings, even if they leave the company. This ensures that employees can take full advantage of retirement savings accrued through employer contributions.

Considerations:

-

Plan Specifics: Vesting schedules can vary significantly between different 401(k) plans. Employers have flexibility in setting vesting schedules, but they must comply with minimum vesting standards set by federal law.

-

Impact on Retirement Planning: Employees should consider vesting schedules when evaluating job offers and planning for retirement. Knowing the vesting schedule helps in understanding when employer contributions become fully owned retirement savings.

Summary:

Vesting schedules in 401(k) plans play a crucial role in determining when employees gain full ownership of employer-contributed funds. They are designed to encourage long-term employment and ensure that employees benefit fully from employer contributions to their retirement savings. Understanding the specific vesting schedule of a 401(k) plan is important for employees to make informed decisions about their careers and retirement planning.

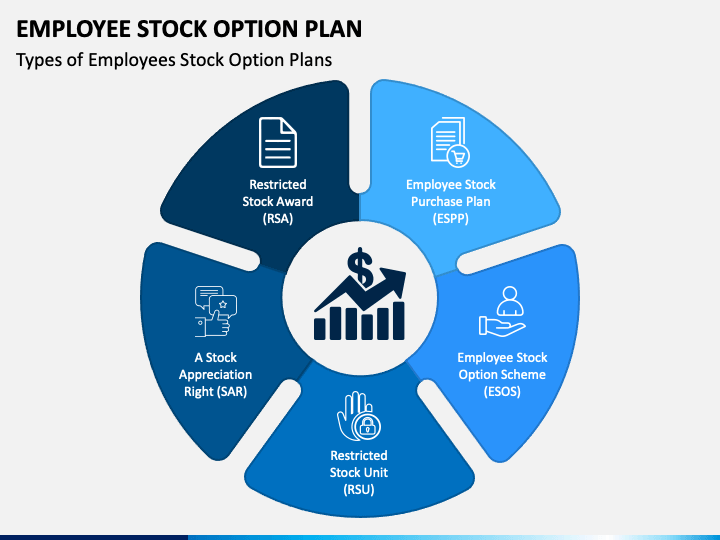

What are Employee Stock Options?

Key Features of Stock Options:

-

Types of Stock Options:

- Call Options: A call option gives the holder the right to buy a specified number of shares at the strike price within a specified period of time.

- Put Options: A put option gives the holder the right to sell a specified number of shares at the strike price within a specified period of time.

-

Strike Price: The strike price is the price at which the option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying stock if they choose to exercise the option.

-

Expiration Date: Options have an expiration date, beyond which they become worthless if not exercised. Options can be short-term (weeks to months) or long-term (up to several years).

-

Exercise: Exercising an option means using the right to buy or sell the underlying stock at the strike price. For employees with stock options, this typically involves purchasing company stock at a predetermined price.

-

Vesting: Stock options often have a vesting schedule tied to employment tenure. Options typically vest over a period of time, incentivizing employees to stay with the company.

Uses of Stock Options:

-

Employee Compensation: Stock options are a popular form of compensation, especially in tech startups and large corporations, to attract and retain talented employees. They align employees’ interests with those of shareholders, as the value of options increases with the company’s stock price.

-

Speculation: Investors and traders use stock options to speculate on the price movements of stocks. They can profit from both upward (buying call options) and downward (buying put options) movements in stock prices.

-

Risk Management: Options can also be used to hedge against potential losses in a stock position. For instance, a stockholder can buy put options to protect against a decline in the stock’s price.

Benefits of Stock Options:

-

Potential for High Returns: Options offer leverage, allowing investors to control a larger position with a smaller initial investment.

-

Flexibility: Options provide flexibility in terms of strategies and positions compared to owning stocks outright.

-

Employee Motivation: Stock options can motivate employees to contribute to the company’s success, as the value of options is tied to the company’s performance.

Risks of Stock Options:

-

Limited Duration: Options have expiration dates, after which they become worthless if not exercised.

-

Volatility: Options can be highly volatile and can result in substantial losses if the market moves against the option holder.

-

Complexity: Options trading involves understanding complex strategies and pricing models, which may not be suitable for all investors.

Conclusion:

Stock options are versatile financial instruments used for various purposes, including employee compensation, speculation, and risk management. They offer potential benefits in terms of leverage and flexibility but also come with risks, particularly related to their limited duration and potential for volatility. Understanding how stock options work and their implications is essential for both employees receiving them as compensation and investors trading them for profit or risk management purposes.

Tax Strategies

Tax planning and tax preparation are both essential components of managing your finances, especially in relation to taxes, but they serve different purposes and occur at different times in the financial cycle:

Tax Planning:

Tax planning involves strategizing throughout the year to minimize tax liabilities and optimize financial outcomes. It is a proactive approach that focuses on legally reducing the amount of taxes owed by taking advantage of available deductions, credits, exemptions, and other tax-saving strategies. Key aspects of tax planning include:

-

Goal Setting: Identifying financial goals and aligning tax strategies to achieve those goals efficiently.

-

Timing of Income and Expenses: Strategically timing when income is received and when expenses are paid to maximize deductions or reduce taxable income.

-

Investment Strategies: Utilizing tax-advantaged accounts (e.g., IRAs, 401(k)s) and investments (e.g., tax-exempt municipal bonds) to minimize taxes on investment income.

-

Business Strategies: Implementing tax-efficient business structures, expense management, and depreciation strategies.

-

Estate and Gift Tax Planning: Planning for the transfer of wealth to minimize estate and gift taxes.

-

Retirement Planning: Contributing to retirement accounts to reduce current taxable income and defer taxes on earnings.

Tax Preparation:

Tax preparation involves the process of gathering, organizing, and filing tax returns to comply with tax laws and regulations. It is a reactive process that typically occurs annually, focusing on accurately reporting income, deductions, credits, and other relevant information to calculate the amount of taxes owed or refund due. Key aspects of tax preparation include:

-

Gathering Documentation: Collecting W-2s, 1099s, receipts, and other documents necessary for accurate tax reporting.

-

Filing Tax Returns: Completing and submitting federal, state, and local tax returns by the filing deadline (usually April 15th in the US, unless extended).

-

Claiming Deductions and Credits: Maximizing deductions and credits to minimize tax liability or maximize refunds.

-

Compliance: Ensuring that tax returns comply with current tax laws and regulations to avoid penalties and interest.

-

Review and Accuracy: Reviewing tax returns for accuracy and completeness before submission to tax authorities.

Relationship Between Tax Planning and Tax Preparation:

-

Continuous Process: Tax planning and tax preparation are interconnected and often influence each other. Effective tax planning throughout the year can simplify tax preparation by ensuring that all relevant information and strategies are in place when it’s time to file taxes.

-

Financial Health: Both tax planning and tax preparation contribute to overall financial health by optimizing tax outcomes, maintaining compliance with tax laws, and minimizing surprises during tax season.

-

Professional Assistance: While individuals can manage basic tax preparation themselves, complex tax planning and preparation often benefit from the expertise of tax professionals (e.g., CPAs, tax advisors) who can provide personalized advice and guidance.

In summary, tax planning focuses on proactive strategies to minimize tax liabilities, while tax preparation involves the annual process of filing tax returns to comply with tax laws. Both are essential for effective financial management and ensuring compliance with tax obligations.

Common Tax Strategies

- Common Business Deductions

- Hire your Family/Children

- Augusta Rule

- Real Estate Cost Segregation

- 1031 Exchange

- Section 179

- Take Advantage of the Section 199A Deduction

What are the most common business deductions?

-

Operating Expenses: These are expenses incurred in the ordinary course of business operations, including:

- Rent: Payments for office space, storefronts, or facilities used for business purposes.

- Utilities: Expenses for electricity, gas, water, and other necessary services.

- Office Supplies: Costs for stationery, printer ink, pens, paper, etc.

- Internet and Phone: Costs related to business internet service, phone lines, and mobile phones used for business purposes.

- Business Insurance: Premiums paid for insurance coverage necessary for the business (e.g., liability insurance, property insurance).

- Professional Services: Fees paid to attorneys, accountants, consultants, and other professional advisors.

- Advertising and Marketing: Costs for promoting the business, including advertising campaigns, website development, and social media marketing.

- Travel and Meals: Business-related travel expenses such as airfare, lodging, and meals (subject to specific rules for deductibility).

- Employee Benefits: Costs associated with providing benefits to employees, such as health insurance premiums and retirement contributions.

-

Salaries and Wages: Payments made to employees, including salaries, wages, bonuses, commissions, and other forms of compensation.

-

Depreciation and Amortization: Deductions for the gradual wear and tear, deterioration, or obsolescence of tangible assets (depreciation) and the allocation of the cost of intangible assets over their useful life (amortization).

-

Cost of Goods Sold (COGS): Deductions for the direct costs of producing goods sold by the business, including materials, labor, and overhead costs directly attributable to production.

-

Interest Expense: Deductions for interest paid or accrued on business loans, lines of credit, or other forms of business debt.

-

Taxes: Various taxes paid or accrued by the business, such as property taxes on business real estate, state and local sales taxes collected from customers, and certain other taxes.

-

Charitable Contributions: Deductions for charitable contributions made by the business, subject to specific limitations and guidelines.

-

Home Office Deduction: Available to businesses that use part of their home exclusively and regularly for business purposes. This deduction can include a portion of rent, utilities, insurance, and depreciation related to the home office.

-

Startup Expenses: Deductions for expenses incurred before the business begins operations, such as costs for market research, advertising, training, and other expenses related to getting the business up and running.

-

Bad Debts: Deductions for debts that become uncollectible during the year, such as accounts receivable that cannot be recovered.

Important Considerations:

-

Recordkeeping: Proper documentation and recordkeeping are essential to substantiate business deductions claimed on tax returns.

-

Tax Laws and Regulations: Tax laws are complex and subject to change. Businesses should stay informed about current tax laws and regulations or consult with tax professionals to ensure compliance and maximize deductions.

-

Specific Industry Deductions: Some industries may have unique deductions or specific rules regarding certain expenses. Businesses should be aware of industry-specific deductions relevant to their operations.

Claiming legitimate business deductions can significantly reduce taxable income and lower the overall tax burden for businesses. However, it’s important to ensure that deductions are properly substantiated and comply with applicable tax laws and regulations to avoid penalties or audits by tax authorities.

How can you hire family/friends for your company?

1. Legitimacy of Employment:

-

Genuine Need: The primary consideration for hiring family members should be the legitimate need for their services in the business. The IRS requires that the work performed is necessary and beneficial to the business.

-

Reasonable Compensation: Compensation paid to family members must be reasonable and comparable to what would be paid to non-family employees for similar work. It should be based on the nature of the work performed, industry standards, and local job market conditions.

2. Documentation and Recordkeeping:

-

Employment Agreement: It’s essential to have a formal employment agreement outlining the terms of employment, duties and responsibilities, compensation, and hours worked.

-

Timekeeping: Family members must keep accurate records of their time worked and tasks performed. This documentation helps substantiate the business purpose of their employment.

-

Payroll Records: Pay family members through regular payroll and ensure all payments are properly documented. Use payroll services or software to manage payroll and deductions accurately.

3. Compliance with Employment Laws:

-

Tax Withholding: Deduct payroll taxes (including federal income tax, Social Security, and Medicare taxes) from family members’ paychecks as required by law.

-

Worker Classification: Ensure family members are correctly classified as employees or independent contractors based on the nature of their work. Misclassification can lead to penalties and liabilities.

4. Benefits of Hiring Family Members:

-

Tax Deductions: Wages paid to family members are deductible business expenses, thereby reducing taxable income and potentially lowering tax liability for the business.

-

Supporting Family Members: Hiring family members can provide them with income, work experience, and opportunities for skill development within the family business.

5. IRS Scrutiny and Documentation:

-

Substantiation: Be prepared to substantiate the business purpose and necessity of hiring family members if questioned by the IRS. Maintain thorough records, including job descriptions, performance evaluations, and evidence of the work performed.

-

Avoiding Abuse: Avoid creating arrangements solely for tax avoidance purposes without legitimate business needs. Transactions must be conducted at arm’s length and in accordance with fair market value principles.

Example Scenario:

- Case Study: A small construction business hires the owner’s teenage child during summer months to perform administrative tasks, such as filing paperwork and assisting with customer service. The business pays the child an hourly wage comparable to local minimum wage rates for similar work. The arrangement is documented with an employment agreement, and the child keeps timesheets recording hours worked.

In summary, hiring family members can be a viable strategy for reducing taxable income through legitimate business expenses. However, it’s crucial to ensure compliance with tax laws, maintain proper documentation, and demonstrate the business necessity and reasonableness of the compensation paid. Consulting with a tax advisor or accountant can provide guidance tailored to your specific circumstances and help ensure compliance with IRS regulations.

What is the Augusta Rule?

The term “Augusta rule” typically refers to a provision related to tax deductions for business-related meals and entertainment expenses. It gained attention and popularized following changes in tax law and IRS regulations. Here’s an explanation of what the Augusta rule is and how it applies:

Background:

In the context of tax deductions, particularly for business-related meals and entertainment expenses, the term “Augusta rule” was informally coined after the IRS issued guidance concerning deductions related to events held at golf courses or similar venues. The rule’s name originates from the Augusta National Golf Club, where the prestigious Masters Tournament is held annually.

Meaning and Application:

The Augusta rule primarily addresses the deductibility of expenses incurred for business-related meals and entertainment activities. Specifically:

-

Business Entertainment Deductions:

- Historically, businesses could deduct 50% of expenses related to business meals and entertainment. This included costs incurred for entertaining clients, business associates, or employees, provided the expenses were directly related to conducting business.

-

Restrictions and Changes:

- The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the deductibility of business entertainment expenses. Under the TCJA:

- Entertainment expenses, such as tickets to sporting events, concerts, or similar activities, are generally no longer deductible.

- Business meals remain partially deductible at 50%, provided they meet certain criteria (e.g., directly related to the active conduct of business, not extravagant).

- The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the deductibility of business entertainment expenses. Under the TCJA:

-

IRS Guidance and Interpretation:

- The IRS issued guidance clarifying the deductibility of business meals at entertainment events, including those held at golf courses or similar venues. The term “Augusta rule” became associated with discussions about the deductibility of meals and entertainment expenses in such contexts.

Summary:

While the term “Augusta rule” is not an official IRS term or regulation, it represents a colloquial reference to IRS rules and guidance regarding the deductibility of business-related meals and entertainment expenses. The rule underscores the importance of understanding current tax laws and regulations governing deductions for business expenses, especially in light of changes introduced by tax reforms such as the TCJA. For businesses and taxpayers, consulting with tax professionals or advisors can provide clarity on allowable deductions and compliance with IRS guidelines concerning business expenses.

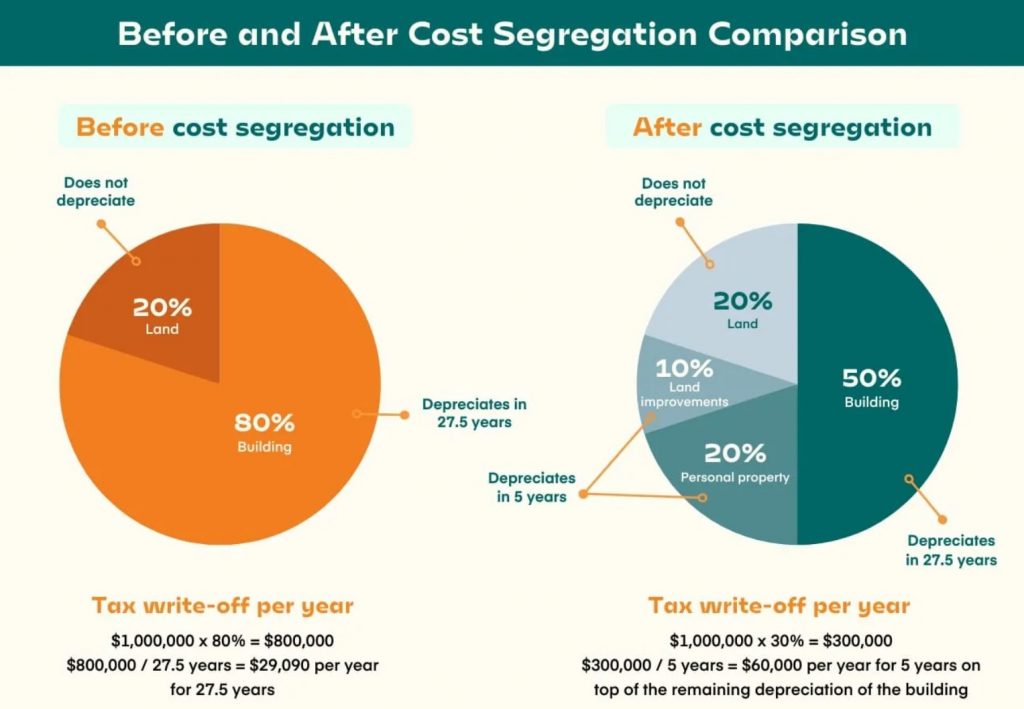

What is Real Estate Cost Segregation?

Cost Segregation Overview:

-

Depreciation Basics:

- Real estate properties are subject to depreciation deductions over time, typically on a straight-line basis over 27.5 years for residential rental properties or 39 years for commercial properties.

-

Accelerated Depreciation:

- Cost segregation allows property owners to identify and reclassify certain components of a property to accelerate depreciation. Instead of depreciating the entire property over 27.5 or 39 years, specific components are depreciated over shorter recovery periods (5, 7, or 15 years), which are typically more reflective of their actual useful lives.

-

Components Eligible for Accelerated Depreciation:

- Components that can be reclassified for accelerated depreciation include HVAC systems, plumbing, electrical systems, decorative millwork, flooring, and certain parts of the building structure that qualify under IRS guidelines.

Benefits of Cost Segregation:

-

Increased Depreciation Deductions: By accelerating depreciation, property owners can deduct a larger portion of the property’s cost in the earlier years of ownership, thereby reducing taxable income and potentially lowering tax liability.

-

Improved Cash Flow: Higher depreciation deductions result in increased cash flow from reduced tax payments, which can be reinvested into the property or used for other business purposes.

-

Tax Deferral: Immediate tax savings can be significant, as accelerated depreciation reduces taxable income in the current year.

-

Potential for Retroactive Benefits: Property owners can perform a cost segregation study on properties acquired in previous years and claim retroactive depreciation deductions, resulting in potential tax refunds or reduced tax liabilities through amended tax returns.

Cost Segregation Study Process:

-

Engaging a Qualified Provider: A cost segregation study is typically conducted by qualified professionals, such as engineers or specialized firms, who assess the property and identify components eligible for accelerated depreciation.

-

Detailed Analysis: The study involves a detailed analysis of construction drawings, blueprints, and other documentation to identify and classify eligible components.

-

Reporting: The results of the study are compiled into a report detailing the reclassified components and their respective depreciation schedules.

IRS Compliance and Requirements:

-

IRS Guidelines: Cost segregation studies must comply with IRS guidelines and regulations. The study report should be well-documented and supported by credible evidence to withstand IRS scrutiny.

-

Professional Expertise: Engaging qualified professionals with expertise in cost segregation ensures compliance with IRS rules and maximizes the benefits of accelerated depreciation while minimizing audit risks.

Considerations:

-

Property Type: Cost segregation is most beneficial for commercial properties, such as office buildings, retail centers, warehouses, and industrial facilities, due to their higher componentization potential.

-

Tax Planning: Integrating cost segregation into overall tax planning strategies can optimize tax benefits and enhance overall financial planning for real estate investments.

In summary, cost segregation is a tax strategy that allows real estate owners to accelerate depreciation deductions by reclassifying certain components of their properties. It can significantly reduce current taxable income, improve cash flow, and provide substantial tax savings, making it a valuable tool for real estate investors seeking to maximize returns and minimize tax liabilities.

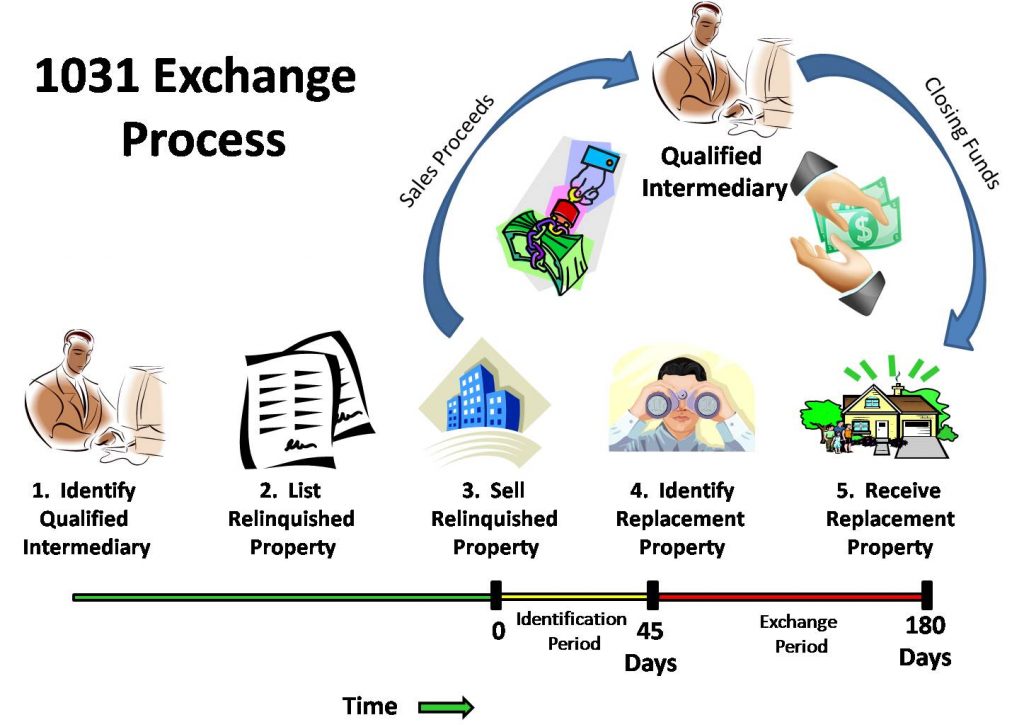

What is a 1031 Exchange?

How a 1031 Exchange Works:

-

Qualified Properties:

- A 1031 exchange applies to investment or business properties held for productive use in a trade or business or for investment purposes. Personal residences and properties held primarily for resale (e.g., house flipping) do not qualify.

-

Like-Kind Requirement:

- The properties involved in the exchange must be of like-kind, which refers to the nature or character of the property rather than its grade or quality. This allows for flexibility in exchanging different types of real estate, such as exchanging an apartment building for raw land or a commercial property for residential rental property.

-

Timing and Deadlines:

- There are strict timelines to follow in a 1031 exchange:

- 45-Day Identification Period: Within 45 days of selling the relinquished property (the property being sold), the investor must identify potential replacement properties.

- 180-Day Exchange Period: The investor has 180 days to close on the purchase of one or more identified replacement properties.

- There are strict timelines to follow in a 1031 exchange:

-

Qualified Intermediary (QI):

- To facilitate the exchange, a Qualified Intermediary (QI) must be used. The QI is a third-party facilitator who holds the proceeds from the sale of the relinquished property and uses them to acquire the replacement property on behalf of the investor. This intermediary role ensures that the investor does not have actual or constructive receipt of the sale proceeds, which is crucial for the exchange to qualify for tax deferral.

-

No Cash or Boot Received:

- To fully defer taxes, the investor must reinvest all net proceeds from the sale of the relinquished property into the replacement property (or properties). If the investor receives any cash or other non-like-kind property (boot) as part of the exchange, it may be subject to immediate taxation.

Benefits of a 1031 Exchange:

-

Tax Deferral: The primary benefit of a 1031 exchange is the deferral of capital gains taxes that would otherwise be due upon the sale of the relinquished property. This allows investors to reinvest the full amount of proceeds into another property, potentially increasing overall return on investment.

-

Portfolio Diversification: Investors can diversify their real estate portfolio without incurring immediate tax consequences, enabling strategic portfolio management and adaptation to market conditions.

-

Estate Planning: 1031 exchanges can be used as part of estate planning strategies to defer taxes indefinitely, as the tax liability is deferred until the investor sells the replacement property without executing another 1031 exchange.

Limitations and Considerations:

-

Strict Rules: Compliance with IRS rules and deadlines is critical to ensure the exchange qualifies for tax deferral.

-

Complexity: 1031 exchanges can be complex, requiring careful planning and coordination with legal, tax, and real estate professionals.

-

No Tax Elimination: While taxes are deferred, they are not eliminated. When the replacement property is eventually sold without a subsequent 1031 exchange, capital gains taxes will be due based on the original gain from the relinquished property.

Conclusion:

A 1031 exchange is a valuable tax strategy for real estate investors seeking to defer capital gains taxes on the sale of investment property. By reinvesting in like-kind properties within specified timelines and using a Qualified Intermediary, investors can defer taxes, enhance cash flow, and potentially increase investment returns through continued property ownership and growth.

What is the Section 179 tax code?

Key Features of Section 179:

-

Qualifying Property:

- Section 179 applies to tangible personal property used in business operations, including machinery, equipment, computers, software, office furniture, vehicles used for business purposes (subject to limitations), and certain improvements to non-residential real property like roofs, heating, ventilation, and air-conditioning.

-

Maximum Deduction:

- The maximum deduction allowed under Section 179 is adjusted periodically by Congress. For tax years 2023 onwards, the maximum deduction is $1,050,000 (subject to inflation adjustments). This means businesses can deduct up to this amount of the cost of qualifying property purchased and placed in service during the tax year.

-

Phase-out Threshold:

- The Section 179 deduction begins to phase out dollar-for-dollar once the total cost of qualifying property placed in service during the tax year exceeds $2,630,000 (again, subject to inflation adjustments).

-

Application to New and Used Property:

- Section 179 can be used for both new and used equipment, as long as the property meets the definition of qualifying property and is used for business purposes.

-

Election and Limitations:

- Businesses must elect to take the Section 179 deduction on their tax return for the year the property was placed in service. The deduction cannot exceed the taxable income of the business for the year, but any excess deduction can generally be carried forward to future tax years.

-

Impact on Cash Flow:

- By allowing businesses to deduct the full cost of qualifying property in the year it is placed in service, Section 179 provides significant cash flow benefits and reduces taxable income for the current year.

Benefits of Section 179:

-

Immediate Tax Savings: Businesses can immediately deduct the cost of qualifying property, reducing taxable income and potentially lowering tax liability for the current year.

-

Encourages Investment: Section 179 encourages businesses to invest in capital assets and technology upgrades by providing a tax incentive upfront rather than spreading out deductions over several years.

-

Simplicity: It simplifies tax planning and compliance by allowing businesses to deduct the full purchase price of qualifying property without the need for complex depreciation calculations over time.

Considerations:

-

Eligibility Requirements: Businesses must meet certain criteria and documentation requirements to qualify for Section 179 deductions. The property must be used for business purposes more than 50% of the time.

-

Consultation: Given the complexities of tax laws and regulations, businesses should consult with tax professionals or advisors to maximize Section 179 benefits and ensure compliance with IRS rules.

Section 179 is a valuable tax planning tool for businesses of all sizes looking to invest in growth and improve cash flow by leveraging tax deductions on qualifying equipment and software purchases.

What is the 199A Tax Code?

Section 199A, often referred to simply as “199A,” is a provision in the U.S. Internal Revenue Code that provides a tax deduction for certain pass-through business income. Enacted as part of the Tax Cuts and Jobs Act (TCJA) in 2017, Section 199A aims to provide tax relief to owners of pass-through entities, such as sole proprietorships, partnerships, S corporations, and certain trusts and estates.

Key Features of Section 199A:

-

Qualified Business Income (QBI):

- Section 199A allows eligible taxpayers to deduct up to 20% of their qualified business income (QBI) from a qualified trade or business operated as a pass-through entity. QBI generally includes income derived from a trade or business conducted within the United States.

-

Eligible Entities:

- Pass-through entities eligible for the Section 199A deduction include:

- Sole proprietorships

- Partnerships

- S corporations

- Certain trusts and estates

- Pass-through entities eligible for the Section 199A deduction include:

-

Thresholds and Limitations:

- The deduction is subject to various thresholds, limitations, and phase-out rules based on taxable income, type of business, and W-2 wages paid by the business.

-

Specified Service Trade or Business (SSTB):

- Income from certain service industries, known as Specified Service Trade or Businesses (SSTBs), may be subject to additional limitations or exclusions from the deduction if taxable income exceeds certain thresholds ($328,000 for married filing jointly in 2023, subject to inflation adjustments).

-

Qualified Property and Limitations:

- Section 199A also includes provisions related to qualified property and other adjustments that may affect the calculation of the deduction.

Benefits of Section 199A:

-